Welcome to the world of the most popular cryptocurrency, where the traditional meets the innovative. If you’re wondering how to invest in Bitcoin, you’re in the right place. Our mission is to demystify Bitcoin investing by offering a clear and actionable roadmap.

From understanding Bitcoin’s fundamental nature to examining various investment strategies, this guide will tackle each aspect step-by-step. We’ll dive deep into the benefits of investing, explore potential risks, discuss how to buy, sell, and securely store coins, and delve into essential investment strategies.

Ready to embark on this comprehensive journey? Let’s get started.

Grasping the Concept of Bitcoin

Bitcoin is a decentralized digital currency, launched in 2009 by an unknown entity known as Satoshi Nakamoto. Unlike traditional currencies, it doesn’t rely on a central bank or government for regulation, making it truly global. And, unlike stocks, it doesn’t represent ownership in a company.

Bitcoin operates on blockchain technology. A blockchain is a public ledger containing all transaction data from anyone who uses bitcoin. And each transaction must be recorded on a block, a link of code that makes up the chain.

Mining refers to the process where miners verify and add transactions to the blockchain. They engage in a competition of brute force computation to solve mathematical problems, and add a new block to the chain.

Now, its value isn’t dictated by a government or financial institution, as most currencies are. Instead, Bitcoin’s value is driven by supply and demand. The demand increases when more people buy bitcoins, and it decreases when more people sell.

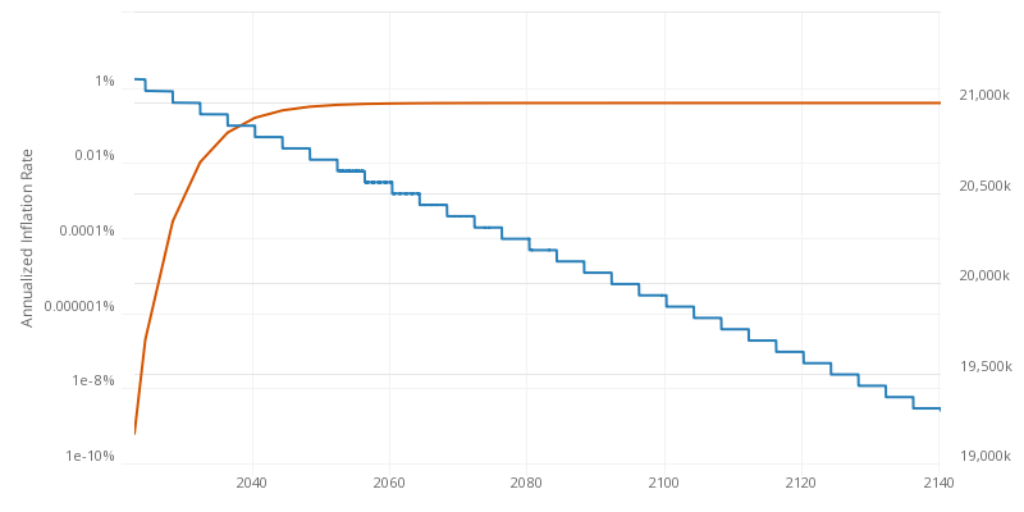

The supply is limited to 21 million coins. And, as demand outstrips supply, the value rises.

Bitcoin effectively combines gold’s salability across time with fiat’s salability across space in one apolitical, immutable, open-source package.

Saifedean Ammous, Author and Economist

There you have it! You’ve just grasped the fundamental concepts of Bitcoin. – the decentralization, the blockchain technology that powers it, the process of mining, and the supply-demand dynamics that determine its value.

Why Invest in Bitcoin

So, why should one consider investing in Bitcoin? The reasons are varied and intriguing.

For starters, the potential for high returns. Bitcoin has seen immense growth over the years, delivering significant returns. While past performance doesn’t guarantee future results, the possibility of high returns remains a strong attraction for many.

Furthermore, Bitcoin’s predetermined supply schedule ensures that only 21,000,000 coins will ever exist, underscoring its growing scarcity in the face of rising demand.

Another compelling reason is liquidity. Bitcoin is traded on various platforms 24/7, globally. This means you can buy or sell coins whenever you want, making it a highly liquid investment.

Diversification is a third compelling reason. Traditional investment wisdom suggests that a diversified portfolio can help mitigate risk. And Bitcoin, given its low correlation with traditional asset classes, could serve as a potential hedge against market volatility.

The properties of Bitcoin also contribute to its allure. Indeed, it’s:

- Unconfiscatable: No one can take it from you, unless they have access to your digital wallet.

- Uncensorable: Nobody can prevent you from transacting.

- Permissionless: You don’t need anyone’s approval to use it.

Bitcoin’s credibility is further enhanced by its growing acceptance as a valid payment method worldwide. Numerous businesses, from startups to established giants, now accept Bitcoin for goods and services.

Beyond its utility as a form of payment, Bitcoin is increasingly viewed as a store of value. Recognizing its potential, many corporations are now adding coins to their treasuries, solidifying its status as a viable and trusted asset for the long term.

In a nutshell, Bitcoin’s potential for high returns, liquidity, and diversification benefits, coupled with its unique properties and increasing acceptance, make it an enticing addition to any investment portfolio.

However, like all investments, it also comes with risks, which we will delve into next.

Risks of Investing in Bitcoin

No investment comes without risks, and Bitcoin is no exception. While it offers unique benefits and has garnered significant attention, it’s vital to understand the potential pitfalls before diving in.

- Volatility: One of the most notable risks associated with Bitcoin is its volatility. Its price can fluctuate dramatically over short periods. These price swings can be influenced by various factors, ranging from regulatory news to market sentiment. For an investor, this can mean rapid gains, but also swift losses.

- Potential for Loss: Just as there’s potential for significant return, there’s also the potential for loss. The decentralized nature of Bitcoin means there’s no central entity to turn to if things go south. As with any investment, there’s no guaranteed return.

- Cybersecurity Risks: Since Bitcoin operates digitally, it’s vulnerable to hacking, fraud, and other cyber threats. If an investor doesn’t adopt adequate security measures, like using hardware wallets or two-factor authentication, they might lose their holdings to malicious entities.

However, recognizing these risks is the first step to mitigating them. One of the golden rules of investing, particularly in high-risk assets, is never to invest money you can’t afford to lose. It’s always advisable to start small, learn the ropes, and gradually increase your exposure if you’re comfortable.

In conclusion, while the digital gold offers significant potential and is reshaping the financial landscape, it’s essential to approach it with caution and knowledge. Now that you’re aware of the risks, let’s move on to the practical steps of how to invest in Bitcoin.

How to Buy Bitcoin

While there are multiple avenues to purchase Bitcoin, including brokers, trading apps, ATMs, and P2P platforms with cash transactions, this simplified guide will primarily focus on buying through exchanges.

1. Choose a Reliable Exchange

Exchanges are platforms where you can buy or sell Bitcoin. Some popular crypto exchanges include Coinbase, Binance, and Kraken. Here’s what you should consider when choosing one:

- Reputation: Do your research. Look for reviews and feedback from other users.

- Security: Prioritize exchanges that emphasize security features, such as two-factor authentication (2FA) and cold storage.

- Fees: Every exchange has transaction fees. Ensure you’re aware of these fees before committing, as they can vary widely.

2. Open an Account at the Exchange of Your Choice

Once you’ve chosen a crypto exchange, sign up on the platform. During registration, be prepared to provide personal details.

Most established exchanges adhere to regulatory standards, meaning you may also need to pass a Know Your Customer (KYC) procedure. This involves verifying your identity using official documents like a passport or driver’s license.

3. Fund Your Exchange Account with Fiat

Once your account is active, the next step is to deposit traditional currency, often termed as “fiat.” Different exchanges offer various deposit methods, such as:

- Bank transfers

- Credit cards/debit cards

- Wire transfers

It’s crucial to check the associated fees with each method. Remember, some funding methods might be instant, while others, like bank transfers, can take a few days.

4. Navigate the Marketplace to Purchase Bitcoin

With your account funded, you’re ready to make your purchase. Navigate to the marketplace or trading section of the exchange. Here, you’ll see a list of available cryptocurrencies. Locate Bitcoin, often denoted as BTC. And then:

- Select the “buy” option

- Input the amount you wish to purchase

- Confirm the transaction details

Once the transaction is complete, your coins will appear in your exchange wallet. However, it’s essential to understand that at this stage, you don’t truly own the Bitcoin; the exchange does, acting as the custodian.

Securely Storing Bitcoin

Owning digital assets like Bitcoin means embracing the responsibility of safeguarding them. With the decentralized nature of cryptocurrencies, security isn’t just recommended—it’s essential.

One common misconception is that using custodial services ensures safety. In truth, when you store your crypto holdings with custodial platforms, like exchanges, you often hold merely an IOU.

A stark illustration of this comes from Celsius Network: a federal bankruptcy judge ruled that cryptocurrencies deposited into interest-bearing accounts at Celsius Network are the property of the firm, not the depositors. Read more about this case on TechCrunch.

For true ownership, consider these self-custody Bitcoin wallets:

| Software Wallets | Hardware Wallets | |

|---|---|---|

| Definition | Apps or software you install on your computer or mobile device. | Dedicated physical devices store your Bitcoin offline. |

| Type | Hot wallet | Cold wallet |

| Pros | They’re convenient and usually free, providing direct control over your Bitcoin. | They’re resistant to online hacking and considered one of the safest options for significant amounts. |

| Cons | They’re more susceptible to cyber-attacks or malware. | They can be lost or damaged, and require a bit more effort for transactions. |

| Examples | Sparrow, Blue Wallet | Ledger, Trezor |

In essence, while custodial services may seem convenient, they come with significant risks. For genuine peace of mind and true ownership, opt for software or hardware wallets and understand their respective strengths and vulnerabilities.

For an in-depth understanding of Bitcoin custody, explore our detailed article at What is Bitcoin Custody?

Selling Bitcoin

Selling Bitcoin and converting it back to fiat currency is generally a straightforward process. You’ll typically follow these steps using a cryptocurrency exchange, the same platform you likely used when purchasing your crypto assets:

- Deposit your Bitcoin into the exchange

- Find the BTC/fiat market

- Place a sell order

- Withdraw your funds in your chosen fiat currency

The decision of when to sell can be multifaceted. Many base this decision on market conditions, their personal financial needs, or a distinction between long-term and short-term investment strategies.

Investing in Bitcoin takes a long-term perspective, with investors holding onto their assets in the belief that they will appreciate over time. Trading, by contrast, operates on a shorter timeline, aiming to capitalize on frequent price fluctuations in the market.

While these are two common approaches, they represent just the tip of the iceberg when it comes to profiting from the virtual currency. Delve deeper and explore a myriad of monetizing strategies in our comprehensive guide on how to make money with Bitcoin.

Remember, in various jurisdictions, selling Bitcoin may come with tax implications. Depending on your residency, your profits might be subjected to capital gains tax, among other potential levies. As such, it’s essential to maintain clear records of all transactions and stay aware of the tax landscape in your region.

Bitcoin Investment Strategies

Navigating the Bitcoin investment landscape can be daunting, but understanding various strategies can pave a clearer path. In the following subsections, we’ll delve into three popular approaches.

Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging (DCA) is an investment strategy where an individual divides the total amount they wish to invest into periodic purchases of an asset, regardless of its price. Instead of putting a lump sum into Bitcoin at once, one might invest a fixed amount weekly, bi-weekly, or monthly over time.

Benefits:

- Mitigating Volatility: Given Bitcoin’s price fluctuations, DCA can help smooth out the investment’s average cost over time. By spreading out the purchase, you reduce the risk of investing a significant sum at a potential high point.

- Discipline and Consistency: DCA instills a disciplined approach to investing. By setting a fixed amount and schedule, it eliminates the need to time the market or make impulsive decisions based on market sentiment.

- Accessibility: Especially for beginners, DCA provides an accessible way to enter the market. Instead of waiting to accumulate a large sum, one can start investing with smaller, more manageable amounts.

- Psychological Comfort: Investing can be emotional, especially with volatile assets. DCA offers a level of psychological comfort, knowing that you’re buying more when prices are low and less when they’re high, leading to a more balanced average purchase price over time.

In essence, while no strategy guarantees profits, DCA is a methodical way of navigating Bitcoin’s unpredictable waters, offering both financial and emotional advantages to investors.

Lump-Sum Investing

Lump-sum investing is the strategy of making a single, one-time investment in an asset, using a substantial amount of capital. Instead of spreading out the purchase over time, as with Dollar-Cost Averaging, an investor allocates a significant sum all at once, hoping to capitalize on a favorable market condition.

Benefits:

- Potential for Immediate Gains: If timed correctly, investing a large sum during a market dip can result in substantial gains when the price rebounds. It capitalizes on those specific moments of perceived undervaluation.

- Simplicity: Lump-sum investing eliminates the need to monitor and make regular investments. It’s a one-time action, which can be especially appealing for those who prefer a hands-off approach.

- Compounding Interest: By investing a large sum upfront, the entire amount starts to compound from day one, potentially leading to higher returns in a growing market.

- Avoiding Missed Opportunities: Markets can be unpredictable. By diving in with a lump sum, investors eliminate the risk of waiting on the sidelines and potentially missing a sustained upward movement in price.

However, while lump-sum investing offers the potential for significant rewards, it also comes with its risks, especially in the crypto market. It’s crucial for investors to do their due diligence, and understand the market conditions before making sizable investments.

Holding Long-Term (“HODLing”)

“HODLing” is a term born from a misspelled forum post on BitcoinTalk.org. But it has since become a popular investment philosophy. It means holding onto your coins for an extended period without succumbing to the urge to sell during market fluctuations. In essence, it’s about having a long-term vision and belief in the asset’s potential growth.

Benefits:

- Minimizing Emotional Trading: Market ups and downs can be nerve-wracking. By committing to HODL, investors insulate themselves from the emotional rollercoaster that can come with frequent trading, potentially reducing impulsive sell-offs during market dips.

- Potential for Long-Term Growth: Historically, Bitcoin has shown a tendency to increase in value over extended periods. HODLing allows investors to potentially benefit from this long-term growth.

- Tax Efficiency: In many jurisdictions, long-term investments often have favorable tax treatments compared to short-term trades. By HODLing, investors might reduce their tax liabilities.

- Reduction in Transaction Fees: Actively trading can accumulate significant fees over time. Holding long-term minimizes these costs, as the asset remains untouched.

- Simplicity: Much like lump-sum investing, HODLing is a straightforward strategy. Once the investment is made, there’s no need for regular monitoring or decision-making based on market movements.

While HODLing can offer substantial benefits, it also requires a strong conviction in the asset’s long-term prospects. It’s essential to understand your risk tolerance and financial goals before committing to this or any investment strategy.

Frequently Asked Questions

Bitcoin is a digital asset classified as a cryptocurrency. As an investment, it’s considered speculative and is known for its price volatility. Due to its innovative nature and potential for high returns, it attracts both retail and institutional investors. However, given its volatility and relative novelty, it’s considered a high-risk asset.

Bitcoin’s potential as a good investment is a subject of much debate, largely dependent on your risk tolerance, investment goals, and time horizon. Historically, it has offered substantial returns, but past performance doesn’t guarantee future results. If you’re considering investing, it’s crucial to conduct thorough research.

Bitcoin’s price fluctuates due to supply and demand dynamics. When demand increases, with buyers willing to pay higher prices, its value rises. Conversely, when demand decreases and there are more sellers than buyers at a particular price point, its value drops.

To invest in Bitcoins, you need a digital wallet to store your cryptocurrency and an account with a cryptocurrency exchange for buying and selling.

The amount of Bitcoin you should buy depends on your financial goals, risk tolerance, and investment horizon. There’s no one-size-fits-all answer. Remember, you can purchase fractions of a Bitcoin, so there’s no minimum required to get started.

Yes, you can engage with the Bitcoin market without directly purchasing the asset, through futures contracts on exchanges, traditional investment funds, ETFs, or by backing companies deeply rooted in Bitcoin. However, each alternative carries its risks and may not mirror its price movement perfectly.

Conclusion

Navigating the intricate world of how to invest in Bitcoin can be both thrilling and daunting. As we’ve journeyed through this guide, remember that it carries its unique blend of potential rewards and risks.

We’ve touched on different investment strategies, from the methodical approach of Dollar-Cost Averaging to the convictions of HODLing. Each strategy caters to specific goals and risk tolerances.

The world of Bitcoin is dynamic, and its landscape is ever-evolving. Hence, the importance of continuous education cannot be overstated. By staying informed, you’re better equipped to make decisions that align with your financial aspirations.

Lastly, for those intrigued by the prospects of Bitcoin but wary of initial capital commitments, there’s good news! We invite you to explore methods to dive into the world of Bitcoin without any upfront capital. Discover how in our comprehensive free BTC earning guide.

As you chart your course in the realm of Bitcoin, remember: armed with knowledge, you’re in a better position to navigate the highs and lows, making the most of this exciting frontier in finance.