Embarking on your Bitcoin adventure? This comprehensive guide simplifies your journey, making it easy to learn how to use Bitcoin, even for beginners. By venturing into digital gold, you’re stepping into the future of finance, unlocking new opportunities for investment, online shopping, and private transactions. We’ll explore how to acquire, safely store, and send Bitcoin, while demystifying the core principles of blockchain. Let’s illuminate this exciting realm, with no technical jargon in sight!

Getting to Know Bitcoin Better

Bitcoin, the first cryptocurrency, is a digital asset that relies on cryptography—codes and encryption—for its operation. Unlike traditional currencies issued by central banks, this digital currency is decentralized, meaning no single entity governs its distribution or value.

[It is] a system for electronic transactions without relying on trust.

Satoshi Nakamoto, Inventor of Bitcoin

Now, picture a public ledger where all transactions are recorded. That’s the blockchain. Blockchain is the technology that underpins Bitcoin, and it’s revolutionary because it allows data to be stored across a network of computers worldwide. These computers, or nodes, work together to validate and record transactions. This decentralization makes the system transparent, resilient to fraud, and free from control by any single authority.

Bitcoin works on the concept of ‘mining’, where complex mathematical problems are solved to add new transactions to the blockchain. For their efforts, miners are rewarded with new coins—this is how new coins enter circulation.

In essence, Bitcoin offers a new way to store and exchange value. It’s a global currency that runs 24/7, and isn’t tied to the economic health of any particular nation.

It’s private, in that your identity is not directly linked to your wallet. But it’s also transparent, as all transactions are visible on the blockchain. And as a borderless currency, it can be sent to anyone, anywhere, without needing to pass through banks or payment processors.

This is just the tip of the iceberg—there’s plenty more to learn. But don’t worry, we’ll guide you through every step, making this journey easy and enlightening. You’re about to unlock a whole new way of navigating the digital economy. So, ready to dive deeper?

How to Obtain Bitcoin

Jumping into Bitcoin starts with getting yourself a Bitcoin wallet, a digital ‘pocket’ where you can safely store your coins. It’s your personal gateway into the ecosystem. For a range of wallet options, bitcoin.org provides a comprehensive guide. But if you’re looking for an easy-to-use mobile option, we’ve got you covered:

- Blue Wallet is an on-chain wallet, meaning it interacts directly with the blockchain.

- Phoenix operates on the lightning network, an additional layer designed to make transactions faster and cheaper.

What if we told you, you can even get your hands on Bitcoin for free? Yes, that’s right. You can earn Satoshis by doing simple tasks or as part of cashback programs. Don’t miss our guide highlighting the best ways to earn free Bitcoin.

Of course, the traditional way to obtain Bitcoin is by purchasing it. There are crypto exchanges, where you can buy coins using your local currency. Websites like Binance, Coinbase, and Kraken are some popular examples. Peer-to-peer transactions are another route, allowing you to buy directly from other users. And, don’t forget Bitcoin ATMs, physical machines where you can exchange your cash or use a debit card.

Alternatively, mining Bitcoin is another method to acquire coins, using dedicated machines to win the next block and earn rewards.

You’ve got a crypto wallet, you’ve got some Sats. What next? In our upcoming section, we’re going to explore how you send and receive Bitcoin. This is where things get fascinating. Stay tuned!

Sending and Receiving Bitcoin

Now that you’ve dipped your toes into the pool, let’s dive into transactions – sending and receiving coins. Just like traditional money, Bitcoin can be transferred from one digital wallet to another. Each transaction is recorded on the blockchain, creating a transparent, secure, and irreversible history of money movement.

Sending Bitcoin is straightforward. First, you’ll need the recipient’s wallet address – a unique string of numbers and letters. You can think of this like their bank account number. They’ll provide it to you, you’ll enter it into your wallet, input the amount to send, review the transaction for accuracy, and then hit ‘send’.

Receiving Bitcoin? Equally simple. You provide your wallet address to the sender. Once they’ve sent the coins, you’ll see them appear in your wallet after the transaction has been confirmed on the blockchain, which typically takes about 10 minutes.

It’s essential to note that Bitcoin transactions are irreversible. This means that once you’ve sent coins, you cannot get them back unless the recipient sends it back to you. So always double-check your transactions!

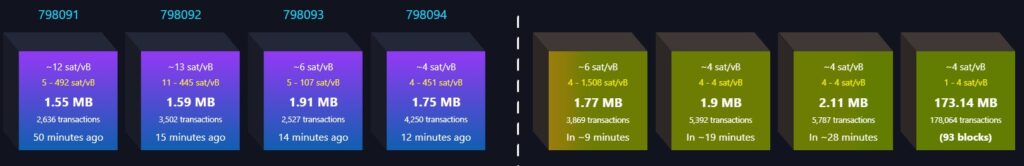

Remember, every transaction comes with a small fee. This fee is given as an incentive to miners to include your transaction in the blockchain.

And there you have it! You’re now ready to start sending and receiving coins. It’s as easy as sending a text message, yet it’s a powerful tool that can help you navigate the world of digital finance. Up next, we’ll discuss how to store your assets safely. Stay with us!

Storing Bitcoin for Savings

Your journey is well underway, but now let’s discuss one of the most important aspects: storing your Bitcoin safely. Think of your wallet as your personal bank vault. There are various types of digital wallets, each with its advantages and considerations.

- Software Wallets: These are programs that you install on your computer. They’re secure and allow direct control over your coins, but they require regular updates for security and might be a bit complex for beginners. Examples include Bitcoin Core and Electrum.

- Mobile Wallets: These wallets are apps on your smartphone, offering convenience as they can be used on the go. Just like software wallets, you control your coins directly. Examples include the previously mentioned Blue Wallet and Phoenix.

- Hardware Wallets: These are physical devices designed to secure coins offline, a method called ‘cold storage’. They’re the most secure way to store coins, but come with a cost. Trezor and Ledger are popular choices here.

Using these wallets involves setting them up with a secure password, and often a recovery phrase – a set of words that can restore your wallet if you lose access to it.

Remember, safety first: always keep your password and recovery phrase private. Treat them like the key to your safe – because they are!

Now that you’re equipped with knowledge about wallets, next, we’re going to delve into various exciting ways to use Bitcoin for purchases, investments, and even trading. Keep reading!

The Potential of Bitcoin

Venturing further into the cryptocurrency realm, let’s explore its diverse potential. From helping you make money, to simplifying global remittances and helping you navigate capital controls, Bitcoin is transforming the financial landscape. Let’s dive in!

Revolutionizing Your Shopping Experience with Bitcoin

Welcome to the new age of shopping, where Bitcoin is changing how we pay for goods and services. Just as you’d use traditional fiat currency to buy items, Bitcoin can be used for purchases, both online and at physical stores.

The list of businesses that accept Bitcoin is growing each day. Major online retailers like Overstock and Newegg accept this form of payment. And you can even use it to pay for your coffee at Starbucks. More and more local businesses, from coffee shops to law firms, are starting to accept the cryptocurrency too.

Purchasing with Bitcoin is not just trendy, it comes with benefits. Indeed, transactions can be faster and cheaper than traditional payment methods, especially for international purchases. Plus, since this form of currency is not tied to any specific country, you can make purchases from anywhere in the world without worrying about exchange rates or international transaction fees.

With Lolli, you can earn cashback while shopping online, turning everyday purchases into a Sat stacking opportunity.

So next time you’re shopping, consider reaching for your Bitcoin wallet. You’ll be part of a growing movement, shaping the future of commerce. As we journey further, we’ll delve into how digital gold is opening up new frontiers for investment. Stay tuned!

Investing in Bitcoin, the New Frontier of Digital Assets

Let’s venture into the fascinating realm of investing. With its exponential growth over the past decade, Bitcoin has established itself as an alternative asset class, attracting everyone from individual investors to large financial institutions.

Bitcoin’s potential for high returns has been a key attraction. For instance, if you had invested just $100 in 2010, it would be worth millions today. This growth potential, coupled with its scarcity — remember, only 21 million coins will ever exist — makes it an appealing choice for investors looking for high-yield assets.

One common strategy for Bitcoin investment is “HODLing” – holding in expectation that its price will rise over the long term. This is based on the belief in its long-term potential as a global currency.

Another approach is regular buying, often referred to as ‘Dollar Cost Averaging’. DCA involves buying a fixed amount of Bitcoin (like $10, $50 or more) at regular intervals (daily, weekly, or monthly), regardless of its price. The idea is to spread out your purchases and reduce the risk of buying all at a high price point.

However, Bitcoin’s volatility means it’s not a risk-free investment. Its price can fluctuate wildly in short periods, and while this can lead to high returns, it can also result in significant losses. As with any investment, it’s important to do your own research and consider your risk tolerance before investing.

Investing in Bitcoin can be an exciting adventure, but it’s also a journey that requires care and understanding. Up next, let’s delve into the dynamic world of trading. Ready to learn more?

Trading Bitcoin: Navigating the Digital Currency Market

Ready to tap into the dynamic world of trading? Trading goes a step beyond simple buying or selling, as it involves speculating on Bitcoin’s price movements to generate profit. It’s like a rollercoaster ride that promises thrills but requires a good understanding of the market.

Trading can be divided into three main types:

- Spot Trading: This is the most basic form of trading, where you buy Bitcoin at its current price and sell it later, hopefully at a higher price. It’s a good starting point for beginners due to its simplicity.

- Margin Trading: Here’s where things get a bit more complex. Margin trading allows you to borrow funds to trade more Bitcoin than you actually own, amplifying potential profits. However, it also amplifies potential losses, and thus, it’s best left to experienced traders.

- Futures Trading: In futures trading, you agree to buy or sell Bitcoin at a specific price in the future. This method allows traders to speculate on the price without owning any coins. It’s a popular choice for advanced traders looking to hedge against potential price swings.

Remember, while trading can be profitable, it’s also risky due to its price volatility. It’s crucial to have a well-thought-out trading strategy and risk management plan. Always be aware of the market conditions and never invest more than you can afford to lose.

From trading, we’re moving to explore how Bitcoin is simplifying global remittances. Strap in for the next part of this adventure!

Simplifying Global Remittances with Bitcoin

Now let’s explore how Bitcoin is transforming global remittances. Remittances, or funds sent by migrants back to their home countries, play a critical role in the global economy, helping to support families and drive growth in many developing nations.

However, traditional remittance channels often come with significant challenges. High transfer fees can eat into the amount sent, while slow processing times can delay money reaching its intended recipients. Furthermore, access to banking services is a major hurdle for many in developing countries, making receiving remittances difficult.

As a decentralized, global currency, Bitcoin is redefining remittances. Here’s how it works: a person can buy Bitcoin in their country using their local currency, send the coins to their family overseas, who can then sell them for their local currency. It’s a peer-to-peer transfer that sidesteps traditional banking systems.

Bitcoin addresses many of the issues plaguing traditional remittances:

- Cost reduction: Transfer fees can be much lower than traditional remittance fees, meaning more money ends up in the hands of the recipient.

- Faster transactions: Remittances can be completed within minutes, a stark contrast to the days it can take with traditional methods.

- Greater accessibility: Anyone with a mobile phone and internet connection can receive coins, making it a game-changer for those in areas with limited banking infrastructure.

In short, Bitcoin is paving the way for simpler, faster, and more affordable global remittances, empowering individuals and fueling economic growth worldwide. Next, let’s explore how it can help navigate capital controls. Stay with us!

Navigating Capital Controls with Bitcoin

Now, let’s explore how Bitcoin can help individuals and businesses navigate capital controls. Capital controls are measures implemented by governments to regulate the flow of money in and out of a country.

Governments may implement capital controls for various reasons, such as stabilizing a volatile economy, curbing capital flight, or controlling inflation. However, these measures can have significant impacts, often restricting economic freedom and posing challenges for individuals and businesses.

As a decentralized currency, Bitcoin operates beyond the scope of traditional banking systems and government control. It’s a financial system that’s open to anyone, anywhere, at any time.

Bitcoin’s key features make it well-suited for navigating capital controls:

- Censorship-resistant: No central authority can stop or reverse transactions.

- Cross-border: You can send coins to anyone, anywhere in the world, regardless of national borders.

- Pseudonymous: While all transactions are transparent on the blockchain, identities are not directly tied to addresses, providing a level of privacy.

In essence, Bitcoin can provide a lifeline in economies with strict capital controls, offering a means for people to preserve their wealth, engage in international trade, or simply send money abroad.

Now that we’ve explored Bitcoin’s diverse potential, let’s look at ways to secure your holdings. Onward!

Safety and Security in Using Bitcoin

Safety and security should always be your top priorities. Remember, the decentralization that gives Bitcoin its power also means you are fully responsible for the security of your funds.

The first line of defense is your wallet. Choose a wallet known for strong security measures, and always protect it with a strong, unique password. Consider using a hardware wallet, a physical device that stores your coins offline, for added security.

Next, consider two-factor authentication (2FA), which adds an extra layer of security by requiring two forms of verification before accessing your wallet or completing transactions. It’s like having a second lock on your safe.

When transacting, always double-check the recipient’s address. One wrong character could send your coins to the wrong destination. Be cautious of unsolicited offers or opportunities that seem too good to be true; they often are.

Remember, transactions are irreversible. Once sent, you can’t get your coins back unless the recipient returns them. This makes understanding security protocols crucial to prevent loss.

However, while these practices enhance your security, challenges and risks remain. Bitcoin’s price is highly volatile, and there’s the risk of losing your investment. You might also become a target for cybercriminals if they know of your holdings.

Conclusion

So there you have it. We’ve journeyed through the foundational aspects of what Bitcoin is and the technology that powers it. We’ve seen how to acquire, send, and receive coins, and the various strategies to store it securely.

We also dove into the myriad ways Bitcoin can revolutionize your financial interactions – from shopping and investing, to trading and remittances, even providing a powerful tool against capital controls. In every corner of our financial world, it has the potential to make significant impacts.

This guide, however, is just the beginning of your journey. Bitcoin’s landscape is vast and ever-evolving, and continued learning is key to harness its full potential.

Now, it’s time for you to get started. Whether you’re looking to send or receive Bitcoin, use it for shopping, or hold it as an investment, remember to do so responsibly and securely. Like any financial endeavor, there are risks involved, but with a good understanding of the basics, you’ll be well on your way to making the most out of this unique cryptocurrency.

So why wait? Dive in, explore, and embrace the possibilities that Bitcoin offers. The future of finance is here, and you’re a part of it.

Ready to secure your Bitcoin? Discover the best wallets for safety and ease.