Welcome to the bedrock of secure private keys management. As we increasingly turn to cryptocurrencies, the importance of safeguarding these unique, powerful keys rises. This comprehensive guide demystifies Bitcoin custody for individuals, organizations, and financial advisors. Together, we’ll explore its inner workings, benefits, and drawbacks, delving into topics like self and third-party custody, and the importance of robust security measures in safeguarding your digital wealth.

What Is Bitcoin Custody?

In the simplest terms, Bitcoin custody involves the secure storage and management of private keys. These private keys, unique strings of characters, act like super-secure passwords that give you access to your coins.

Now, why does crypto custody matter?

Picture this: you’re entrusted with a unique, priceless artifact. If it gets lost or stolen, there’s no way to replace it. Your mission is to protect it at all costs. That’s exactly the role of Bitcoin custody for your private keys.

Given the irretrievable nature of private keys, losing them means losing access to your coins permanently. And if they fall into the wrong hands, your digital assets can be swiftly drained without a trace. That’s why securing these keys is paramount.

For individual investors, Bitcoin custody brings a sense of security and control over their digital assets. For financial institutions and investment professionals, it’s even more crucial. It helps them comply with regulations that often require them to entrust assets to a qualified custodian.

How Does Bitcoin Custody Work?

Bitcoin custody begins with the creation of a wallet, which generates a pair of cryptographic keys:

- A public key, which is like your email address.

- A private key, which is more like your super-secret password.

The private key is the piece of information that needs to be safeguarded, as it allows you to access and manage your digital assets. Usually, it’s stored either in hot or cold storage, or often a combination of both, based on the requirements of accessibility and security.

But storage is only the first layer of security.

Bitcoin custody adds multiple layers of protection, such as encryption, where the private keys are transformed into unreadable code that can only be deciphered with a specific decryption key.

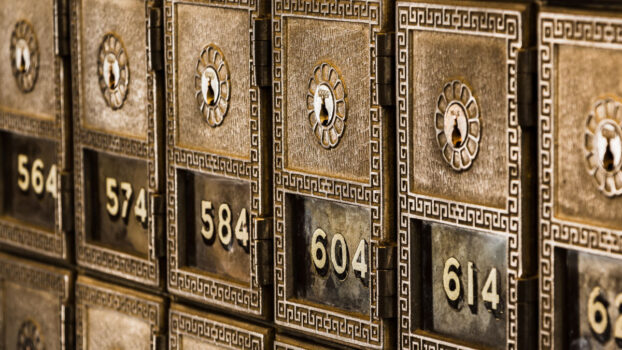

Another level of protection comes with the multi-signature process, which requires more than one key to authorize a transaction. This is akin to a safe deposit box that requires two keys to open; even if one key is compromised, the assets remain secure.

Interested in understanding more about seed phrases and their crucial role in Bitcoin security? Dive deeper into this topic by visiting our guide about seed phrases.

Types of Bitcoin Custody

We encounter various types of crypto custody options, each with its unique set of features. In this section, we’ll delve into the nuances of each option, empowering you to make an informed decision about safeguarding your digital assets.

Self-custody

Self-custody, as the name implies, involves you being your own custodian. You hold and manage your cryptographic keys, thus retaining full control and access to your coins. This is typically done using hardware wallets, paper wallets, or secure digital wallets that you can manage on your own devices.

When you self custody your bitcoin, and whatever happening in whole crypto space is endless entertainment.

Matt Odell, Bitcoin and privacy advocate

The most significant advantage of this option is the complete control it offers. Your assets are not dependent on any third party. There’s no need to trust another entity, eliminating the risk of malpractices from custodial services.

Moreover, you have immediate access to your funds, which can be advantageous in volatile crypto markets where timing can be crucial.

However, with great power comes great responsibility. The downside of this type is that the safety of your digital assets rests entirely on your shoulders. Losing your keys can mean losing your assets, with no way to recover them. Moreover, it requires a solid understanding of digital security practices to guard against theft or hacking. Mistakes can be costly and irreversible.

Additionally, for large investors and financial institutions, self-custody might not be a practical or compliant solution. Regulations often require these entities to use a qualified custodian.

Third-party custody

Third-party custody involves entrusting your cryptographic keys and thereby your digital assets to an external entity. This could be a financial institution, a dedicated firm, or a specialized custody service. They handle the safekeeping and management of your digital assets.

One of the key advantages of this type is that it eases the burden of security. You don’t need to spend resources to maintain secure storage for your assets. The custodians invest heavily in security infrastructure. And their sole focus is to protect your assets, which could result in better security than what you might achieve on your own.

Moreover, most third-party custodians are insured and regularly audited, providing extra layers of protection and peace of mind. They also comply with regulations, making them a practical solution for larger investors and institutions subject to such regulatory requirements.

On the flip side, it does mean relinquishing some control over your assets. You have to trust the custodian with your keys. And there’s always a risk of custodial failure, that leads to loss of funds, as what happened with Prime Trust.

Access to your funds might also be slower, depending on the custodian’s protocols. Plus, there are usually fees associated with these services.

Partial custody

Partial custody is a hybrid model that combines elements of self and third-party custody. In this scenario, you share control of your keys and digital assets with a third-party custodian.

The most common arrangement involves multi-signature wallets, where more than one key is required to authorize transactions.

Its beauty lies in its balance of control and security. You maintain some degree of direct control over your assets, while also benefiting from the professional security measures provided by the custodian.

A key advantage of this model is that it reduces the risk of losing access to your assets. Even if you lose your key, the custodian still has a key, and your assets can be recovered. Similarly, if the custodian’s key is compromised, your key can prevent unauthorized transactions.

Moreover, the multi-signature arrangement offers protection against both external threats (like hackers) and internal threats (like fraudulent transactions by the custodian), as all transactions require approval from both parties.

However, this method is not without its drawbacks. It requires a higher level of collaboration and coordination for every transaction, which can slow things down.

Also, it still involves trusting a third party to some extent, which may not appeal to those wanting total control. Lastly, there are usually fees involved for the custodian’s services.

How to Choose the Right Type of Bitcoin Custody?

Choosing the right type of crypto custody boils down to understanding your individual needs and circumstances. Here are a few key factors to consider when making your choice.

First, consider the volume of crypto assets you hold. If you’re managing a large volume of assets, using a third-party or partial custody service can provide the necessary security infrastructure and regulatory compliance. For smaller volumes, self-custody might be sufficient.

Next, assess your risk tolerance. Are you comfortable bearing the responsibility for the security of your assets? If the thought of losing your keys keeps you up at night, a third-party or partial custody solution might be more suitable. However, if you value control over your assets and have a higher risk tolerance, self-custody could be the way to go.

Technical know-how is another critical factor. Managing your own keys in a self-custody scenario requires a good understanding of digital security practices. If you’re not confident in your technical abilities, it’s worth considering third-party or partial custody.

Time commitment and convenience are also crucial. Third-party and partial custody services often take care of security updates and other maintenance, freeing up your time. On the other hand, self-custody can be more hands-on, requiring ongoing effort to maintain security.

Lastly, consider regulatory requirements. If you’re an institution or a large investor, you might be obligated to use a qualified custodian.

Frequently Asked Questions

Yes, Bitcoin custody can be very safe when proper security measures are in place. However, it’s not entirely immune to risks such as hacking or loss, so continual vigilance and best security practices are essential.

Crypto exchange and custody serve different purposes. An exchange is a platform where you can buy, sell, or trade cryptocurrencies. On the other hand, crypto custody involves the safekeeping of the keys used to access and manage digital assets. While some crypto exchanges also offer custody services, these are two distinct functions.

Bitcoin custodians generally make money by charging fees for their services. These can include setup fees, transaction fees, and ongoing maintenance or storage fees. The fees can be based on a flat rate, a percentage of the total assets under custody, or a combination of both.

Yes, banks can serve as crypto custodians. In fact, the Office of the Comptroller of the Currency (OCC) clarified in 2020 that national banks and federal savings associations could provide custody services for crypto assets.

Conclusion

In conclusion, securing your digital wealth hinges on your understanding of Bitcoin custody. We’ve unearthed what it is, why it matters, and how it functions to safeguard your private keys, your priceless artifacts.

There are different custody type: Self, third-party, and partial. And each comes with varying degrees of control and security.

No matter which custody type you choose, continuous learning and staying updated with best practices will be key to your success. Our blog offers a wealth of information and guides to help you traverse this digital landscape confidently.

Emphasizing the value of self-custody, it’s worth mentioning that it offers an unparalleled level of autonomy over your assets. It is a cornerstone for financial sovereignty in the digital asset space.

Finally, finding the right storage solution is just as crucial. It’s time for you to discover how to safely store your coins, and support your journey towards financial sovereignty.