If you’re just starting out with Bitcoin, you might be wondering about the best way to store your digital assets. In this friendly guide, we’ll explore the hot wallet vs cold wallet debate and help you understand their key differences. By the end, you’ll have a clear idea of which storage option suits your needs. So, let’s dive in and demystify these wallet types!

The Difference Between Hot Wallets and Cold Wallets

When it comes to storing your digital currency, you have two main options: hot wallets and cold wallets. Let’s take a look at what they are and how they relate to Bitcoin storage.

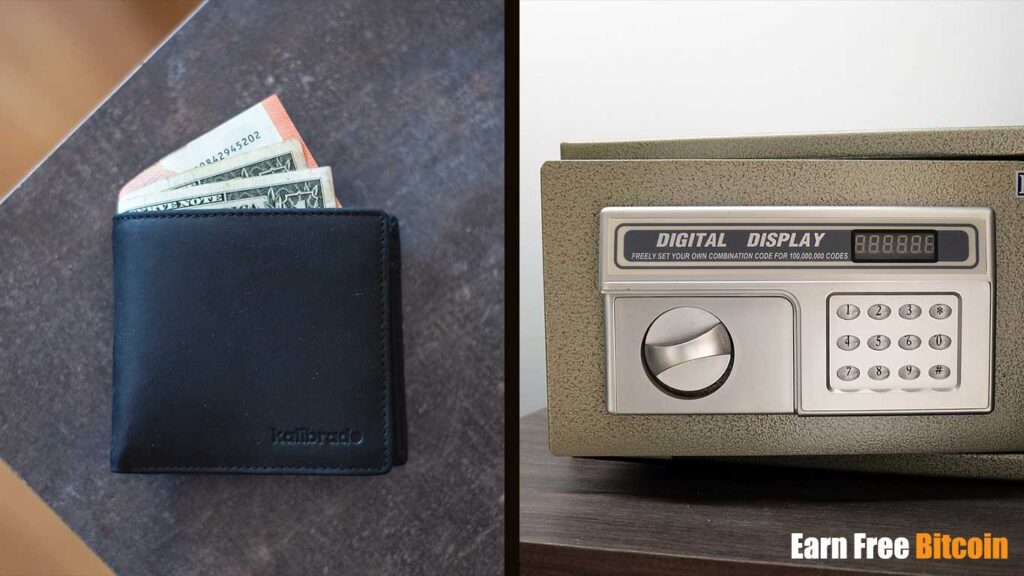

Hot wallets are connected to the internet, making them easy to access and manage your digital assets. They’re like your regular billfold, keeping your spending money handy.

On the other hand, cold wallets are offline storage devices. They’re similar to a safe deposit box, storing your valuable assets long-term.

Now, let’s see how these types of wallet differ:

- Security level: The primary difference between hot and cold wallets is their level of security. Since hot storage is online, it’s more vulnerable to cyberattacks. Cold storage offers superior protection by being offline and less exposed to potential threats.

- User experience: Hot wallets are generally more user-friendly, as they’re designed for everyday use. They allow you to easily manage, send, and receive coins with just a few clicks. Cold wallets require more effort to access and use, making them better suited for long-term storage.

- Cost: Hot storage is typically free or low-cost, as it comes in the form of apps or web services. Cold storage, on the other hand, can be more expensive. Indeed, it often requires the purchase of a dedicated hardware device.

- Compatibility with digital assets: Most hot wallets support a wide range of cryptocurrencies, making them a convenient choice for those who want to manage multiple digital assets. Cold wallets, however, may have limited compatibility and may require you to use separate devices or software for different cryptocurrencies.

In a nutshell, hot storage offers convenience and ease of use, while cold storage prioritizes security and long-term holding. Understanding these differences is essential to make an informed choice in the hot wallet vs cold wallet debate.

Cold Wallets Are More Secure

Security is a top concern for Bitcoin holders, and cold storage has a clear advantage in this area. Compared to hot Bitcoin wallets, cold wallets offer enhanced protection due to their offline storage and limited connectivity.

Storing your digital assets offline means they’re less vulnerable to hacking and other online threats. Unlike hot wallet solutions, which are permanently online, cold wallets remain disconnected. This makes it significantly harder for hackers to access your digital funds.

This is the way. Buy. Cold store. Repeat.

Adam BACK, computer scientist, inventor of Hashcash, CEO of Blockstream

While paper wallets exist, the most popular type of cold storage is the hardware wallet. It’s a physical device designed for secure Bitcoin storage. These devices are equipped with a secure element chip and hardware-level security features, which provide an additional layer of protection. The secure element chip stores your private keys, ensuring they’re not exposed even if the device is connected to a compromised computer.

Limited connectivity is another reason cold storage devices are more secure. As they’re not perpetually online, it’s more difficult for unauthorized users to access your funds. This restricted access, combined with the cold storage wallet’s physical nature, results in a highly secure environment for your digital assets.

A cautionary tale that highlights the potential risks associated with using hot storage is the Deribit hot wallet hack. Deribit, a cryptocurrency exchange, lost 28 million USD when hackers targeted its hot storage solution.

In summary, cold storage offers a much more secure solution compared to hot storage due to its offline property, physical device, and limited connectivity. For crypto investors who prioritize the security of their assets, hardware devices are the preferred choice. While they may not be as convenient as online solutions for everyday crypto transactions, they’re an excellent choice for long-term storage and safeguarding significant investments.

Hot Wallets Are More Convenient

While hardware devices offer superior security, hot wallets have their own advantages, with convenience being the most notable. In this section, we’ll compare hot and cold wallets. And we’ll highlight why hot storage is considered more convenient for daily use.

First, let’s discuss their ease of accessibility. Unlike cold wallets, which are typically stored offline, hot wallets can be accessed from anywhere with an internet connection. This makes them perfect for those who need to manage their coins on the go or frequently make transactions.

Secondly, hot Bitcoin wallets allow for quick and easy transactions. In comparison, cold wallets can be slower and require more steps to complete a transaction. For instance, to send funds, you need to connect the device to an internet-enabled computer, unlock the device, sign the transaction, and then broadcast it to the network. Hot wallets streamline this process, enabling you to send and receive Satoshis with just a few clicks.

Additionally, hot wallets are designed with the user in mind, offering a more intuitive and user-friendly experience. Many apps and services prioritize usability, featuring clean interfaces and easy navigation. This contrasts with cold wallets, which can be more complex to set up and use, especially for beginners.

In conclusion, hot storage solutions excel when it comes to convenience. Their ease of accessibility, regular transaction capabilities, and user-friendly design make them an ideal choice for those who want a simple, hassle-free way to manage their digital assets. While they might not be as secure as cold wallets, hot wallets strike a balance between ease of use and security. And they are a popular choice for everyday transactions and managing smaller amounts of cryptocurrency.

Hot Wallets Are Cheaper, Some of Them Are Free

Another advantage of hot storage is its affordability. In this section, we’ll discuss how hot wallets are generally more cost-effective compared to cold storage solutions. And why this makes them an attractive option for those new to cryptocurrency or working with limited funds.

Hot wallets often come in the form of mobile apps or web-based services. And they are either free or available at a low cost. This affordability makes them a popular choice for individuals or businesses just starting with cryptocurrency. Indeed, it allows them to experiment and learn without making a significant financial investment in a hardware device.

It’s essential to carefully consider the trade-off between convenience and security when choosing a storage solution. While hot wallets are cheaper and more accessible, they may not be suitable for storing large amounts due to their increased vulnerability to online threats.

In summary, hot wallets offer a more affordable option for Bitcoin storage, with some even being available for free. Their lower cost and easy accessibility make them an attractive choice for beginners or those on a budget. However, it’s crucial to remember that this convenience comes with a trade-off in security.

Hot Wallets May Be Compatible With More Assets

In addition to their affordability and convenience, hot storage often boasts another advantage: compatibility with a broader range of digital assets. In this section, we’ll explain why hot wallets may support more cryptocurrencies than cold wallets.

Hot wallets can interact with multiple crypto exchanges and trading platforms, enabling users to store, trade, and manage a wider variety of digital assets. This flexibility makes them appealing to those who want a one-stop solution for managing their crypto investments. With hot wallets, you can quickly switch between different cryptocurrencies. And you can take advantage of market opportunities without needing separate storage solutions for each asset.

However, their increased compatibility comes with higher security risks, as these connected wallets are more vulnerable to cyberattacks. Additionally, some providers may not give you full control over your private keys. And this could be problematic if the provider experiences issues or shuts down.

Users need to be cautious when choosing a hot wallet, especially if they plan to store a significant amount of assets. It’s essential to research the provider’s security measures and reputation before entrusting them with your digital wealth. Balancing the convenience of managing multiple assets with the need for security is crucial in making an informed decision.

In conclusion, their expanded compatibility and seamless integration make hot wallets a good choice for users who want to buy, sell, and trade a variety of crypto assets. However, users must weigh these benefits against the increased security risk and potential lack of control over private keys.

Pros and Cons of Using Hot and Cold Wallets

In this section, we’ll provide a clear and concise breakdown of the pros and cons of using hot and cold wallets. As a result, you can make an informed decision on which type of wallet best suits your needs.

Pros and Cons of Hot Wallets

Hot storage wallets offer several advantages. First, they are easily accessible and allow users to manage their coins and tokens on the go. Second, they are often free or available at a low cost, making them an affordable option for beginners or those on a budget. Third, they tend to support a wider range of digital assets and can interact with multiple exchanges and trading platforms. Lastly, they typically have intuitive interfaces and streamlined processes, making them easy to use, even for beginners.

On the downside, hot storage solutions come with some drawbacks. First, they are connected to the internet and more vulnerable to hacking and other online threats. Additionally, some providers may not give users full control over their private keys, which can be risky if the provider experiences issues. Finally, due to their security risks, hot wallets may not be suitable for storing significant amounts of Bitcoin.

Pros and Cons of Cold Wallets

Cold wallets offer several advantages, such as enhanced security because they provide offline storage and limited connectivity. They also give users full control over their private keys, ensuring better protection of their funds. Additionally, they are better suited for storing large amounts of Bitcoin or for long-term investment purposes, making them an ideal choice for more substantial holdings.

On the other hand, cold wallets have some disadvantages, such as cost, as they can be expensive. They are also less convenient, as they are not as easily accessible and require additional steps to complete transactions. Additionally, some devices may only support a limited range of digital assets. So, you might need to use multiple storage solutions if managing a diverse portfolio.

Frequently Asked Questions

A cold wallet can be worth it for individuals who prioritize the security of their digital assets. Cold storage options offer superior protection due to offline storage and limited connectivity. And they’re ideal for storing large amounts of crypto or long-term investments. However, they can be more expensive, if you’re not using a piece of paper. Ultimately, the decision depends on your specific needs, risk tolerance, and investment strategy. If security is a top priority, and you’re willing to invest in a more secure storage solution, a cold wallet is definitely worth considering.

Hot wallets are generally safe for everyday use and smaller amounts of Bitcoin, as they provide convenience and accessibility. However, they are connected to the internet, making them more vulnerable to hacking and online threats. Some providers may also offer limited control over private keys. That’s why it’s crucial to research the provider’s security measures and reputation before use. For storing large amounts or long-term investments, cold storage methods are a safer option.

To secure your hot wallet, follow these steps: 1) Choose a reputable provider with a strong track record in security. 2) Enable two-factor authentication (2FA) for added account protection. 3) Use a strong, unique password that is not easily guessable or used for other accounts. 4) Regularly update your software to ensure you have the latest security patches. 5) Be cautious of phishing attempts and only access your wallet through verified sources. 6) Avoid using public Wi-Fi networks.

Conclusion

In this article, we’ve explored the key differences between cold and hot wallets, along with their respective pros and cons.

Hot wallet solutions are known for their convenience, affordability, compatibility with various digital assets, and user-friendly interfaces. However, they come with increased security risks, limited control over private keys, and may not be suitable for storing large amounts of Bitcoin.

On the other hand, cold wallets provide enhanced security due to their offline storage and limited connectivity. They also give users control over their private keys and are ideal for long-term storage of significant amounts of Bitcoin. Their downsides include higher costs, less convenience, and potentially limited compatibility with digital assets.

Considering the trade-offs of both wallet types, using a combination of the two is often the ideal approach. This way, you can take advantage of the convenience and accessibility of hot storage for everyday transactions and smaller amounts. And you can rely on the security of cold storage for safeguarding larger sums and long-term investments.

It’s crucial to understand the differences between hot and cold wallets and choose the type that fits your specific needs and risk tolerance.

To help you make an informed decision, we encourage you to discover the best Bitcoin wallets available in the market. This comprehensive guide will provide you with insights and recommendations, allowing you to choose a solution that perfectly aligns with your requirements and preferences.