Every four years, the community buzzes with anticipation over a pivotal event: the halving. But what is Bitcoin halving, and why does it hold such significance? This phenomenon not only halves the mining reward, thereby influencing its scarcity and value, but it also has profound implications for the wider economy.

In this guide, we’ll explore the basics of Bitcoin, unravel the mystery behind halving, delve into its historical effects, prepare for the next event, and underscore its importance. Get ready to understand why this event is a cornerstone in the digital currency landscape.

Basics of Bitcoin

Bitcoin stands as a groundbreaking digital currency, independent of central authorities like governments or banks.

It operates on a decentralized network, leveraging blockchain technology. This technology acts as a public ledger, recording all transactions across a network of computers (nodes). It ensures both transparency and security.

The process of Bitcoin mining underpins this network. Miners use powerful computers to participate in a sort of lottery. This serves two key roles:

- Verifying transactions on the blockchain,

- Generating new coins.

Mining is inherently competitive. The first to find a winning ticket adds a new block of transactions and earns BTC as a reward. This competition ensures the network’s integrity.

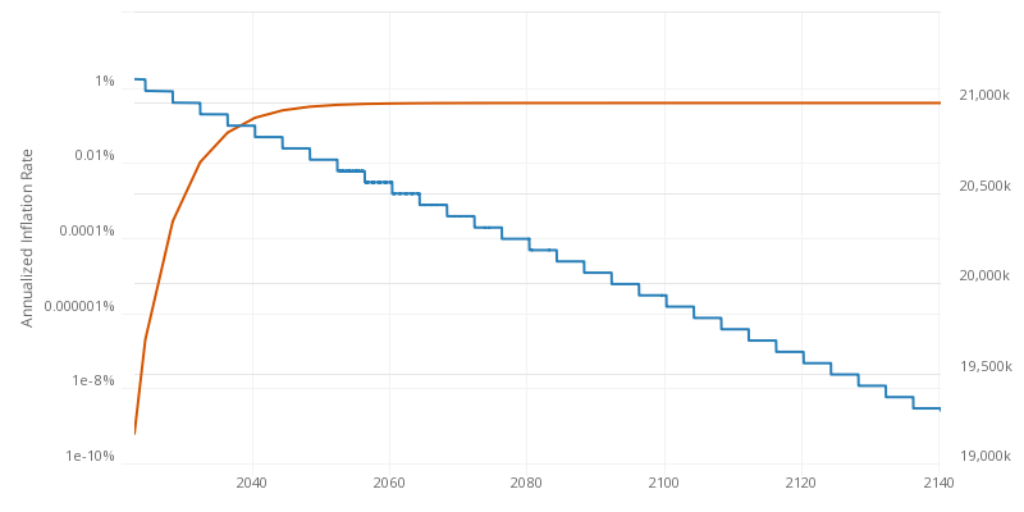

A hard cap of 21 million Bitcoins exists, aiming to prevent inflation. This cap was set by its creator, Satoshi Nakamoto. New coins enter the market through mining. Yet, their generation rate halves roughly every four years, in an event called Bitcoin halving.

What Is Bitcoin Halving?

Bitcoin halving is a key event hard-coded into the protocol. It cuts the reward for mining a block by half. This happens every 210,000 blocks, or roughly every four years. And it controls the release of new coins until reaching the 21 million maximum supply.

Total circulation will be 21,000,000 coins. It’ll be distributed to network nodes when they make blocks, with the amount cut in half every 4 years.

First 4 years: 10,500,000 coins

next 4 years: 5,250,000 coins

next 4 years: 2,625,000 coins

next 4 years: 1,312,500 coins

etc.

Satoshi Nakamoto in The Cryptography Mailing List

Initially, miners received 50 BTC per block. Due to halving, this reward has decreased over time.

Halvings are predictable, forming part of Bitcoin’s monetary policy. The process is designed to continue until the last coin is expected to be mined around the year 2140.

Halving impacts miners, investors, and the broader market. It changes mining incentives and can affect the digital asset’s price. For those orange-pilled, understanding halving is crucial. It shows how the economy works.

Why Does Bitcoin Halving Occur?

Satoshi Nakamoto introduced Bitcoin halving to mimic the scarcity and value preservation seen in precious metals, like gold. By doing so, Nakamoto aimed to establish it as “digital gold.” Halving serves a crucial purpose: controlling its inflation rate and ensuring its scarcity.

Every halving reduces the rate at which new coins are created. This gradually limits the supply, much like gold’s finite quantity on Earth. Over time, this scarcity can increase Bitcoin’s value, assuming demand continues or grows.

This contrasts with fiat currencies, subject to government printing. Unlike endless printing, leading to inflation, halving curtails the supply. It acts as a deflationary measure that could potentially increase Bitcoin’s purchasing power over time.

Halving is more than just a technical event; it reflects Nakamoto’s vision for a sustainable, decentralized currency. It’s a deliberate measure to secure the asset’s future as a store of value. Understanding this intention is key for anyone involved in the space. It highlights Bitcoin’s unique position as a hedge against the inflationary policies of traditional fiat currencies.

Historical Halvings and Their Impact

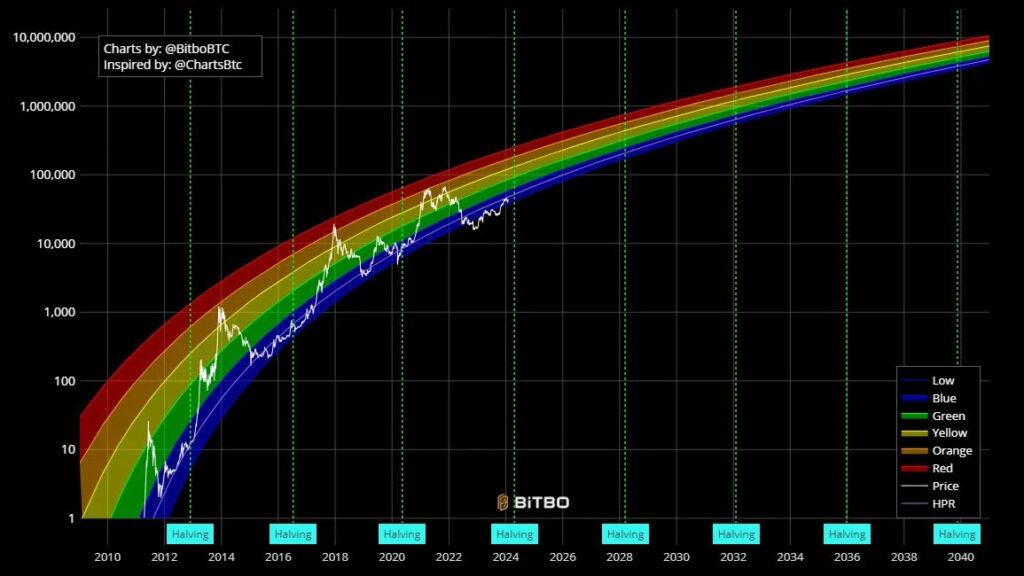

Bitcoin has undergone several halving events since its inception. Each event has been a milestone in its history, marked by significant anticipation and analysis within the community.

| Bitcoin Halving | Reward Pre-Halving | Reward Post-Halving | Date |

| 1st | 50 BTC | 25 BTC | November 28, 2012 |

| 2nd | 25 BTC | 12.5 BTC | July 9, 2016 |

| 3rd | 12.5 BTC | 6.25 BTC | May 11, 2020 |

| 4th | 6.25 BTC | 3.125 BTC | April 20, 2024* |

Historically, halvings have led to notable price volatility. In the months following each halving, Bitcoin’s value has typically seen a substantial increase, eventually reaching new all-time highs (ATH).

The miner community has also been impacted by halving cycles. Each reduction in rewards has prompted concerns about profitability, leading some miners to exit the market. Following the third halving, the Bitcoin hash rate dropped by 30%, as unprofitable machines were unplugged. However, the subsequent price rallies have historically offset these reduced mining rewards.

Miners adapt by seeking more efficient mining technologies and cheaper energy sources.

Market sentiment around halvings generally leaned positive, with many viewing these events as bullish indicators. Investors and traders often regarded halvings as precursors to potential price increases, leading to heightened trading activity and increased interest in the deflationary asset.

Preparing for the Next Bitcoin Halving

As the next halving approaches, both investors and miners are positioning for potential changes. Historically, halving cycles have led to price increases and market optimism. Investors might consider increasing their holdings before the halving, anticipating long-term gains as supply tightens and demand potentially rises.

For miners, the reduction in block rewards means reassessing the cost-effectiveness of their operations. Investing in more energy-efficient mining hardware or seeking regions with lower electricity costs can help maintain profitability. Miners should also prepare for short-term revenue drops by optimizing their mining strategies and possibly diversifying income sources.

Market reactions to previous halvings suggest a pattern of initial volatility followed by a bullish trend. Investors should be ready for possible price fluctuations in the short term, with an eye on the historical tendency for prices to climb post-halving.

However, it’s crucial to consider the broader economic and regulatory environment, as these factors also influence the market dynamics.

Ultimately, preparing for the next halving involves strategic planning and a deep understanding of past trends. Both investors and miners can benefit from staying informed about technological developments and market indicators.

As always, a balanced approach that considers both the opportunities and risks will be key to navigating the future of Bitcoin investing and mining.

Frequently Asked Questions

Bitcoin halving can be seen as both good and bad, depending on perspective. Investors often view halvings positively, as they tend to lead to increased prices. Miners, however, can find them challenging, as they see their rewards cut by 50%, potentially impacting profitability. In the broader sense, halving is good for the Bitcoin ecosystem, reinforcing its deflationary nature and helping to maintain its value over time.

The next Bitcoin halving will occur about four years from the last one. The most recent halving happened in May 2020, so the next one should happen in April 2024. The exact date can vary slightly due to fluctuations in the time it takes to mine blocks. Tracking the current block height of the blockchain on Clark Moody’s dashboard, for example, can provide a more precise estimate.

Based on Bitcoin’s issuance schedule and the halving formula, there will be a total of 33 halvings. This number is determined by how many times the block reward can be halved until it reaches zero.

The last Bitcoin halving is expected to occur around the year 2140. This projection is based on the fixed schedule of halving occurring every 210,000 blocks, approximately every four years, and the limited supply of 21 million coins.

After the last Bitcoin halving, we will have reached the finite supply cap of 21 million coins. Miners will no longer receive mining rewards. Instead, their compensation will shift entirely to transaction fees paid by users for processing transactions.

Conclusion

In this article, we’ve navigated through the essentials of Bitcoin halving, shedding light on its mechanism, significance, and the ripple effects it has on the ecosystem.

From the basics of Bitcoin and the intricacies of mining to the scheduled nature of halvings and their profound impact on its price, miner behavior, and market sentiment, we’ve covered the pivotal aspects that every enthusiast should understand.

Understanding the halving mechanism is crucial for anyone involved in the space. It’s a cornerstone event that not only influences the economic landscape, but also reinforces its foundational principle as digital gold.

Halving ensures its scarcity, echoing the sound money principle that protects value over time.

As we look toward future halvings and the evolution of the Bitcoin network, it’s important to deepen your understanding of sound money principles. For those interested in exploring this concept further, the work “The Principle of Sound Money” by the Mises Institute offers valuable insights.